Straight line method of depreciation example

The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset. The method takes an equal depreciation expense each year over.

Depreciation Expense Double Entry Bookkeeping

The extract of the annual report of LT is.

. Under the prime cost method also known as the straight-line method you claim a fixed amount each year based on the following formula. This means that an equal amount will be. So if you bought a machine for 50000 and placed it in service for 10 years the annual depreciation expense would be 50000 divided by 10 or 5000 per year.

You can use the 6th. While the straight. Calculating Depreciation Under Reducing Balance Method.

Example of straight-line depreciation without the salvage value. Assume that Company X purchases an asset at the cost of 20500. For example if a companys machinery has a 5-year life and is only valued 5000 at the end of that time the salvage.

For property except for property classified as IRC section 280F. To illustrate this we assume a company to have purchased equipment on January 1 2014 for 15000. In accountancy it is.

Using the straight-line depreciation method a company will allocate the same percentage of an assets value for each accounting period. The useful life assumed is 5 years that is till December 2019. Prime cost straight line method.

You may take the deduction for New York depreciation until the property is fully depreciated or disposed of. Variable declining method which is a mix between the declining balance amortization and the straight line depreciation approaches. For example vehicles are assets that depreciate much faster in the first few years.

Depreciation is estimated at 20 per year on the book value. Straight line basis is a depreciation method used to calculate the wearing out of an assets value over its serviceable lifespan by assuming an equal depreciation expense each accounting period. Accelerated depreciation is any method of depreciation used for accounting or income tax purposes that allows greater deductions in the earlier years of the life of an asset.

It contains a 6th and 7th optional argument. The calculation of depreciation under this method will be clear from the following example. Straight Line Depreciation Method is one of the most popular methods of depreciation where the asset uniformly depreciates over its useful life and the assets cost is evenly spread over its useful and functional life.

Over time this value will decrease as the assets value decreases. A small business decides to purchase a new printer for its. Double Declining Balance Depreciation Method.

Suppose the cost of asset is 1000 and rate of depreciation 10 pa. Depreciation can be computed without any difficulty. The straight-line depreciation method is the.

The default method of doing this is via the straight-line method. The asset in this example cost 80000 was acquired on the first day of the income year and has an effective life of five years. Therefore an accelerated depreciation method is often chosen.

The straight-line depreciation method is the most widely used and is also the easiest to calculate. Depreciation Value Straight Line is higher so we switch to Straight Line calculation. Here the company does not estimate a salvage value for the equipment.

For example lets say that you buy new computers for your business at an initial cost of 12000 and you depreciate their value at 25 per year. In this example VDBCostSalvageLife03 reduces to 2000 1600 1280 4880. The following is an example of a straight line depreciation calculation.

Here you allocate a fixed dollar amount of depreciation every year over the useful life of the asset. York depreciation by using one of the methods provided for in IRC section 167 as it was in effect on December 31 1980 for example straight line or declining balance. Double declining balance method is an accelerated approach by which the beginning booking value of each period is multiplied by a constant rate of 200 of the straight line depreciation rate.

With a straight line depreciation method. If we use Straight line method this results in 2 remaining depreciation values of 67772 2 33886. LT also provides depreciation on its assets using SLM.

Computation of depreciation under straight line method is comparatively easy and simple. Under the straight line method depreciation is provided evenly over the lifetime of an asset at a constant rate. Straight Line Depreciation Formula Example 3.

On 1 January 2016 XYZ Limited purchased a truck for 75000. The assets life expectancy is 20 years with 1500 as the. Example of Depreciated Asset.

Another example of using the straight-line method of depreciation can be seen from the Financial Statements of Larsen Toubro LT.

Straight Line Method For Calculating Depreciation Qs Study

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

How To Calculate Straight Line Depreciation Depreciation Guru

Straight Line Depreciation Accountingcoach

Depreciation Straight Line Method Or Original Cost Method Lecture 1 Youtube

Straight Line Depreciation Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Method To Get Straight Line Depreciation Formula Bench Accounting

Depreciation Straight Line Method Or Original Cost Method Lecture 2 Youtube

Depreciation Methods Principlesofaccounting Com

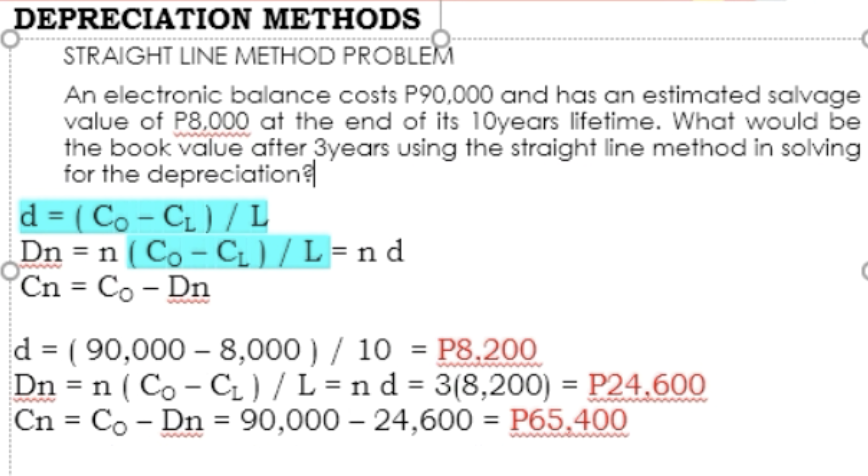

Solved Depreciation Methods Straight Line Method Problem An Chegg Com

Depreciation Methods Straight Line Sum Of Years Digits Declining Balance Calculations Youtube

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

What Is Straight Line Depreciation Method Pmp Exam Youtube

Lesson 7 Video 3 Straight Line Depreciation Method Youtube

Straight Line Depreciation Formula Guide To Calculate Depreciation

Straight Line Depreciation Formula And Calculation Excel Template