Federal tax taken out of paycheck

If no federal income tax was withheld from your paycheck the reason might be quite simple. You probably received a Form 1099-MISC instead of a W-2 to report your wages.

Understanding Your Paycheck Direct Deposit Advice Jmu

Discover Helpful Information And Resources On Taxes From AARP.

. If this is the case. See how your refund take-home pay or tax due are affected by withholding amount. Your employer withholds 145 of.

2021 Income Tax Brackets Taxes Now Due October 2022 With An Extension For the 2021 tax year there. The failure-to-file penalty is normally 5 percent of the monthly delinquent tax. Simplify Your Day-to-Day With The Best Payroll Services.

You would be taxed 10 percent or 900 which averages out to 1731 out of each weekly paycheck. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percentThe amount of federal income tax an employee owes depends on their income level and filing status for example whether theyre single or married or the. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

Federal income taxes are paid in tiers. Your bracket depends on your taxable income and filing status. What is the percentage that is taken out of a paycheck.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. How It Works. Why are no federal taxes taken from paycheck 2020.

For the employee above with 1500 in weekly pay the. And 137700 for 2020Your employer must pay 62 for you that doesnt come out of your pay. Medicare Taxes Medicare taxes unlike Social Security tax go to pay for expenditures for current Medicare beneficiaries.

Medicare tax is 145 on all income over 200000 per year for single filers and 250000 for married filers. First you need to determine your filing status to understand your tax bracket. The federal income tax has seven tax rates for 2020.

Step 1 Filing status There are 4 main filing statuses. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. The government uses federal tax money to help the growth of the country and maintain its upkeep.

This total represents approximately how much total federal tax will be withheld from your paycheck for the year. There are seven federal tax brackets for the 2021 tax year. What happens if no federal taxes are taken out of my paycheck.

Youll sometimes hear this referred to as pre-tax income and it means two things. If you chose to file exempt no federal income tax will be taken out of your Leave and Earning Statement. Estimate your federal income tax withholding.

If youre considered an independent contractor there would be no federal tax withheld from your pay. Federal withholding is money that is withheld and sent to the IRS to pay federal income taxes. Its important to revisit your tax withholding especially if major changes from the Tax Cuts and Jobs Act affected the size of your refund this year.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Typically employees and their employers split that bill which is why employees have 62 and 145 respectively held from their paychecks. For a single filer the first 9875 you earn is taxed at 10.

Also What is the percentage of federal taxes taken out of a paycheck 2021. What percentage of federal taxes is taken out of paycheck for 2020. Take your new withholding amount per pay period and multiply it by the number of pay periods remaining in the year.

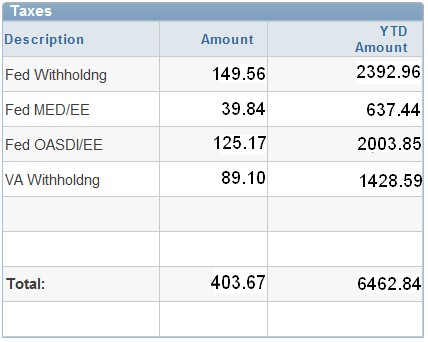

If you dont file a tax return you may face penalties and interest. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. An explanation of the amounts taken out of your check follows the paycheck statement.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. No Medicare or Social Security would have been withheld either. Only the very.

What percentage of federal taxes is taken out of paycheck for 2020. The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total. Why are no taxes taken out of paycheck.

The failure-to-pay penalty is typically 05 percent. These are the rates for taxes due. Most people working for a US.

His withholding is calculated using the tax tables in the IRS Publication 15 and the EDD DE 44. Individuals who make up to 38700 fall in the 12 percent tax bracket while those making 82500 per year have to pay 22 percent. There are also 24 32 35 and 37 percent tax brackets.

Employer have federal income taxes withheld from. In the United States the Social Security tax rate is 62 on income under 127200 per year. Use this tool to.

The amount of federal income tax an employee owes depends on their income level and filing status for example whether theyre single or. In this case Joes filing status is single with zero exemptions. You face the same problem f you file a return and dont pay the taxes due.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. This tax will apply to any form of earning that sums up your income whether it comes for employment or capital gains. There are two types of payroll taxes deducted from an employees paycheck.

Social Security and Medicare. The IRS and other states had made sweeping changes to employee withholding. 2021 tax preparation software.

You wont have to pay federal taxes on forgiven loans but states could tax it as income. How do I not owe federal taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks.

Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net earnings. The Federal Income Tax is a tax that the IRS Internal Revenue Services withholds from your paycheck. In fact your employer would not withhold any tax at all.

The federal income tax has seven tax rates for 2020. Next add in how much federal income tax has already been withheld year to date. What percentage of my paycheck is withheld for federal tax.

Contributions to a traditional 401 plan come out of your paycheck before the IRS takes its cut. Even if you did a Paycheck Checkup last year you should do it again to account for differences from TCJA or life changes. Reason 1 The employee didnt make enough money for income taxes to be withheld.

Combined the FICA tax rate is 153 of the employees wages. Calculate your paycheck in 5 steps There are five main steps to work out your income tax federal state liability or refunds. Choose an estimated withholding amount that works for you.

1 you wont pay income tax on those contributions and 2. Single Married Filing Jointly or Widow er Married Filing Separately. 10 12 22 24 32 35 and 37.

Ad Choose From the Best Paycheck Companies Tailored To Your Needs.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Decoding Your Paystub In 2022 Entertainment Partners

Here S How Much Money You Take Home From A 75 000 Salary

Irs New Tax Withholding Tables

What Are Payroll Deductions Article

Paycheck Taxes Federal State Local Withholding H R Block

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Paycheck Calculator Online For Per Pay Period Create W 4

Different Types Of Payroll Deductions Gusto

Pay Stub Meaning What To Include On An Employee Pay Stub

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Understanding Your Paycheck

Check Your Paycheck News Congressman Daniel Webster

Understanding Your Paycheck Credit Com

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Understanding Your Paycheck Youtube